You may have heard stories in the news about the property insurance crisis in Florida, where insurance has become very expensive and very hard to get, but things are becoming just as bad here in California. State Farm and Allstate have stopped issuing new property insurance policies in California, and Farmers has capped the number of new policies they will sell here. These 3 companies provide 40% of all the property insurance in California. Many other insurance companies have also left the California market.

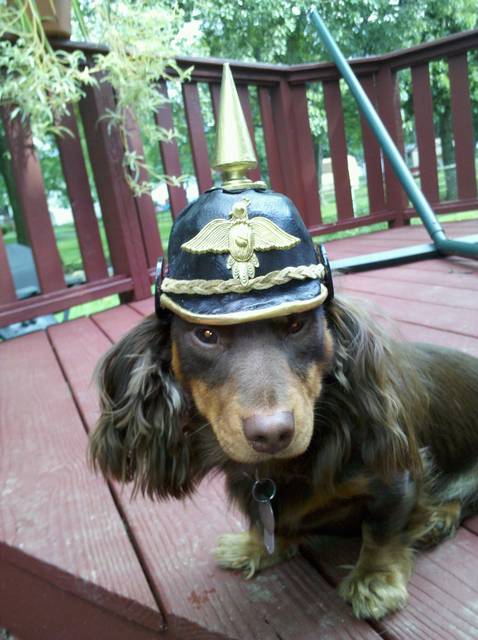

The main reasons for this are that that insurance payouts for wildfire losses have skyrocketed along with repair and reconstruction costs. Plus, the insurance industry considers California an overregulated and unfriendly place to do business. The state legislature should be taking action to keep insurance companies here in California, but they are doing just the opposite. The legislature is getting ready to vote on a bill (AB2216) requiring landlords to accept pets and prohibiting landlords from asking any questions about an applicant’s pet prior to approving the application. An insurance company may not care if they see a couple of 20-pound dachshunds in an apartment house they insure, but what do you think will do if they see pit bulls or 100-pound rottweilers there?

SECURITY DEPOSITS.

As I said in my February newsletter, the California legislature recently passed a new law limiting the amount of security deposits in large apartment rentals. The maximum security deposit used to be 2 month’s rent. It is now 1 month’s rent. The insurance industry considers this another unfriendly law. After all, the less money a landlord has to cover the cost of damages done by a tenant, the more likely he will be to file a claim with his insurance company if he has a loss. How this new law might affect the insurance industry was never taken into consideration during the debate over this law. By itself, this law isn’t going to drive insurance companies out of the state, but the cumulative effect of lots of laws like this make California look like an increasingly risky and expensive place for insurance companies to do business.

HOW TO REDUCE YOUR RISK OF GETTING YOUR INSURANCE CANCELLED.

If your insurance company is leaving the state, there is nothing you can do about that; however, there is a lot you can do to reduce the chance that you will get a non-renewal letter on your home or rental property. That’s by making your property look less risky to an insurance company. Keep in mind that in addition to personal inspectors, insurance companies now also use drones to look over the properties they insure.

1. Replace your roof as soon as possible if the roof is coming to the end of its useful life. A worn-out roof may not be visible from the street, but it is the first thing that a drone sees. An insurance company views a worn-out roof as evidence of general neglect of the property.

2. Keep your roof, gutters, and yards free of debris.

3. Make sure the trees and bushes on your property are well maintained. Cut back tree branches that overhang your building or that are dead.

4. Don’t use yards, walkways, stairs, or porches for storage.

5. Keep your decks and railings in good condition. If you have to replace a ground-level wood deck, replace it with concrete pavers.

6. There should be no junk outside the building.

7. Look over your property regularly. The main risk property insurance companies are looking for in California are fire risks. Insurance companies don’t like to see vegetation right up against a building they insure. Try to keep vegetation at least 5 feet away from the building. Fill this area with gravel or concrete, not grass or tree bark.

WORST APPLICANT EVER.

It Was Police Brutality! This story illustrates why I want to be able to question applicants about their pets. I used to own a house near the Rockridge BART station. Once, when it was up for rent, I got a phone call from a man who said: “I saw your listing. It says you’ll allow a dog.” I said: “Yes. That’s right.” He said: “What about 2 dogs?” I said: “No. I’m only allowing 1 dog.” He said: “OK” and hung up. A few days later, this same guy called back and said: “Is your house on Canning Street still available?” I said: “Yes, it is still available, but didn’t you call me a few days ago, and didn’t you tell me that you have 2 dogs? I’m still only allowing 1 dog.” He said: “Yeah, we did speak a few days ago, and I had 2 dogs then, but I’ve only got 1 dog now.” I was suspicious. I asked: “What happened to your other dog?” He said: “A cop shot him.” I said: “A policeman shot your dog? Why?” He said: “It was police brutality. It was so sad. He was the gentlest dog I ever had.” I asked: “What happened?” He said: “My dog was playing with the mailman, and the neighbors called the cops. Then the cops came out and shot my dog. It was police brutality.” I didn’t like the sound of that explanation. His story raised several questions in my mind:

1. What does this guy mean by “playing with the mailman?” That sounded scary to me.

2. If the mailman and this dog were really just playing, why did the neighbors call the police? People don’t call the police just because they see somebody playing with a dog, and the police won’t come out if that’s all that’s going on.

3. If this was the gentlest dog this guy ever owned, what is his other dog like?

WHY DO DOGS GET ONE FREE BITE?

If you have never heard of the ‘one free bite’ rule before, you might assume that I made up this story. It sounds completely preposterous. However, I don’t make up these stories.

In 16 states, a dog has a legal right to bite you - once. That means that in a ‘one free bite’ state, you cannot sue a person if his dog bites you once, no matter how much damage the bite does. In a ‘one free bite’ state, if somebody’s dog bites a finger off your hand in just one bite, you cannot sue the owner for your loss or even your medical bills; however, you can sue the dog’s owner if the dog bites off your finger on a second bite. The ‘one free bite’ rule is a 16th century English legal principle that was adopted by British colonies all over the world. It is still the rule of law in many states. I grew up in Maryland, which is a ‘one free bite’ state. In Maryland, you cannot sue a dog’s owner if the dog only bites you once unless you can prove that the dog’s owner had foreknowledge that his dog was dangerous. The first bite is ‘on the house’. The ‘one free bite’ rule is not one of those silly old laws that is still on the books but that nobody enforces. No. The ‘one free bite’ rule is still enforced in the courts of Maryland, New York, Virginia, Texas, and many other states. (Sounds unbelievable, doesn’t it?)

California. Dogs do not get ‘one free bite’ here in California. California is a strict liability state, which means that a dog’s owner can be sued for all injuries inflicted on another person by his dog. If a dog bites you here in California, judges and juries usually don’t care how many bites the dog took. They are only interested in how much damage the dog did in determining damages.

The subject of dog bite liability comes up all the time at landlord conventions. Personally, I think that the ‘one free bite’ rule should be abolished – everywhere and immediately. This archaic, medieval legal concept runs contrary to modern thinking about personal responsibility.